Letter Of Credit Providers

Introduction:

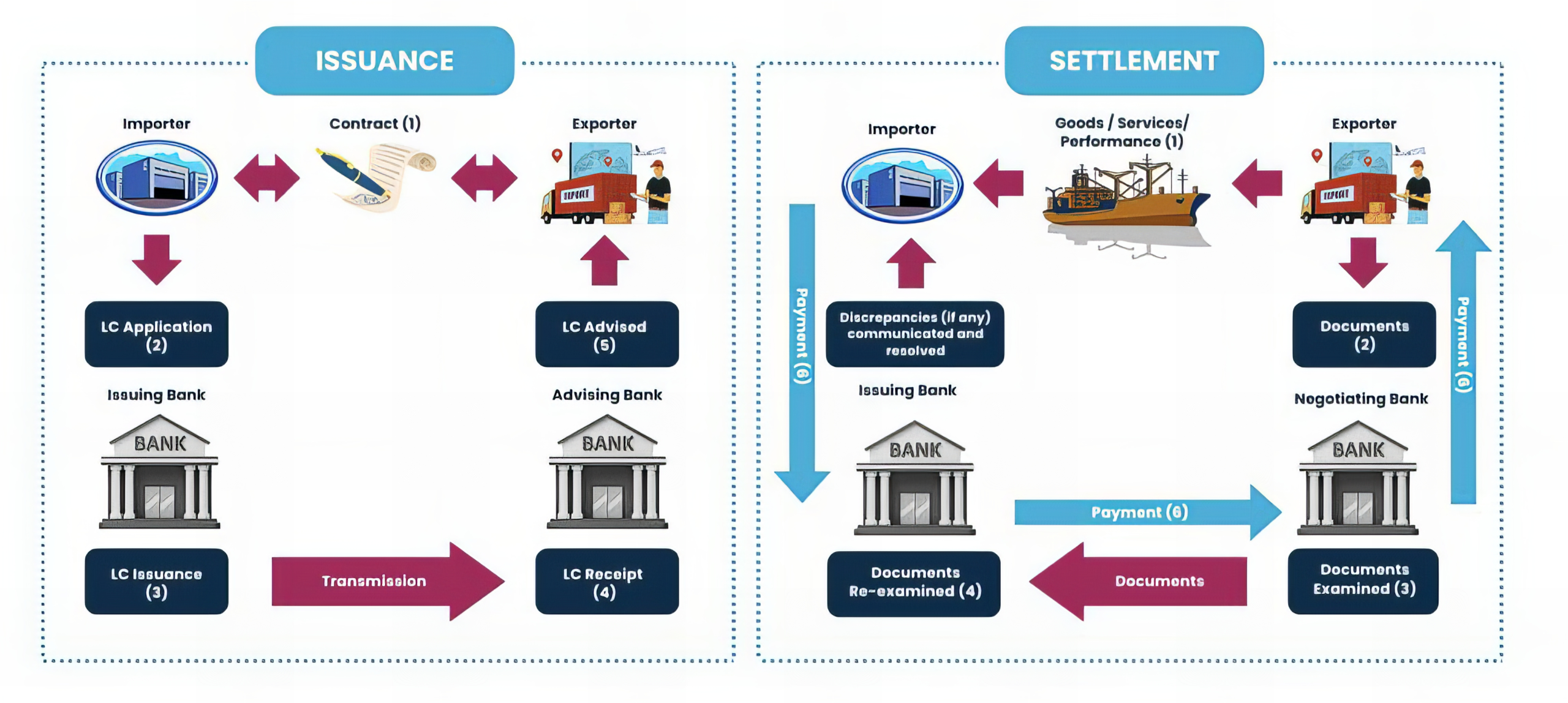

A Letter of Credit (LC) is a vital financial instrument in international trade, ensuring that payments will be made as per the agreement between the buyer and the seller. At Rukan Finance, we provide expert assistance in obtaining and managing Letters of Credit to facilitate secure and efficient trade transactions for your business in Dubai.

What is a Letter of Credit?

A Letter of Credit is a guarantee from a bank that a buyer’s payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment, the bank will cover the full or remaining amount of the purchase. This instrument is widely used in international trade to mitigate the risks associated with trading across borders.

Why Use a Letter of Credit?

- Security: Provides security to both buyers and sellers by ensuring payment and delivery as per agreed terms.

- Risk Mitigation: Reduces the risk of non-payment for sellers and ensures buyers receive their goods or services.

- Trust Building: Enhances trust and confidence between trading partners, facilitating smoother transactions.

- Compliance: Ensures compliance with international trade regulations and standards.

Types of Business Bank Accounts:

Revocable and Irrevocable LCs

Determine whether changes can be made to the LC without the consent of all parties.

Confirmed and Unconfirmed LCs

Enhanced payment security through verification and backing from an additional confirming bank.

Sight and Time LCs

Payment is made either immediately upon demand or on a specified future date.

Transferable and Back-to-Back LCs

Ideal for businesses with global partners, enabling transactions across various currencies.

Our Letter of Credit Services:

- Consultation and Advisory: Expert advice on the type of LC that best suits your business needs and trade requirements.

- Issuance of LC: Assistance with the preparation and issuance of Letters of Credit through reputable banks.

- Document Preparation: Guidance on preparing and verifying the necessary documents to meet LC terms and conditions.

- Negotiation and Discounting: Support in negotiating and discounting LCs to improve your cash flow.

- Amendments and Extensions: Assistance with amendments and extensions of LCs as required by changing trade conditions.

- Dispute Resolution: Expert support in resolving any disputes or discrepancies that may arise during the LC process.

Conclusion:

At Rukan Finance, we understand the complexities of international trade and the importance of securing your transactions. Our comprehensive Letter of Credit services are designed to provide you with the security and confidence you need to conduct your business smoothly and efficiently. Contact us today to learn more about how we can support your trade operations with our expert LC services.